Montreal, Quebec--(Newsfile Corp. - October 24, 2019) - Maple Gold Mines Ltd. (TSXV: MGM) (OTCQB: MGMLF) (FSE: M3G) ("Maple Gold" or the "Company") is pleased to report a new Mineral Resource estimate for the Company's Douay Gold Project, as prepared by Roscoe Postle Associates Inc. ("RPA"). In addition to new drill data from the winter 2018 and 2019 campaigns, the new estimate integrates the Company's new 3D geological and structural model to better constrain gold mineralisation. At cut-off grades of 0.45 g/t Au for open pit resources and 1.0 g/t Au for underground resources, the Douay deposit is estimated to contain Indicated Mineral Resources of 8.6 million tonnes at an average grade of 1.52 g/t Au, and Inferred Mineral Resources of 71.2 million tonnes at an average grade of 1.03 g/t Au (see Table 1; Figs. 1, 2).

The estimate includes several conservative adjustments with the aim of delivering a new resource estimate that will focus infill and step-out drilling to optimise existing resources and advance the deposit toward the economic study stage. These adjustments and changes include:

- Adjustments to the conceptual pit shell slope assumptions (less steep) with pit shells now also extending to shallower depths

- Adjusted search ellipses with reduced projections between holes and from the last hole on the edge of any given mineralised zone

- Updated capping methodology, levels and spatial restriction to control the influence of higher-grade samples

- Improved bulk density modelling of individual geological domains

Maple Gold's President & CEO, Matthew Hornor, stated: "This new estimate marks a major milestone for our technical group, with a new comprehensive 3D model, conservative adjustments to better constrain reported resources, and an increased focus on economic parameters. Our primary objective is to advance and de-risk the deposit as we aim to secure strategic partnerships and bring the project to the economic study stage in the near future. The large gold endowment at Douay provides excellent leverage to a higher gold price environment, but our team believes that demonstrating improved economic viability for a subset of the total contained ounces at Douay will add significant value and further optionality in terms of potential development plans."

Table 1 - Mineral Resource Statement as at October 23, 2019

| Category | Tonnage (Mt) | Grade | Contained Metal |

| (Au g/t) | (000 oz Au) | ||

| Pit Constrained Mineral Resources | |||

| Indicated | 8.6 | 1.52 | 422 |

| Inferred | 65.8 | 0.97 | 2.045 |

| Underground Mineral Resources | |||

| Inferred | 5.4 | 1.75 | 307 |

| Total Mineral Resources | |||

| Indicated | 8.6 | 1.52 | 422 |

| Inferred | 71.2 | 1.03 | 2,352 |

Notes:

- CIM (2014) definitions were followed for Mineral Resources.

- Mineral Resources are reported at an elevated cut-off grade of 0.45 g/t Au for open-pit Mineral Resources and a cut-off grade of 1.0 g/t Au for underground Mineral Resources.

- The Whittle pit shell used to estimate Mineral Resources used a long-term gold price of US$1,500 per ounce, however the implied gold price for the Mineral Resources reported at the elevated cut-off grade would be significantly lower.

- A US$/C$ exchange rate of 0.7, and a gold recovery of 90% were used.

- A minimum mining width of 3 m was used.

- Open pit resources are reported within a preliminary pit shell.

- Bulk density is 2.71 t/m3 or 2.82 t/m3 depending on the zone.

- Numbers may not add due to rounding.

- Mineral Resources for Douay have been updated using data available to October 23, 2019.

Click the following link to view cut-off grade sensitivity table reporting tonnages and grades within the pit shells at cut-offs ranging from 0.25 - 0.65 g/t Au: https://bit.ly/2obMteS

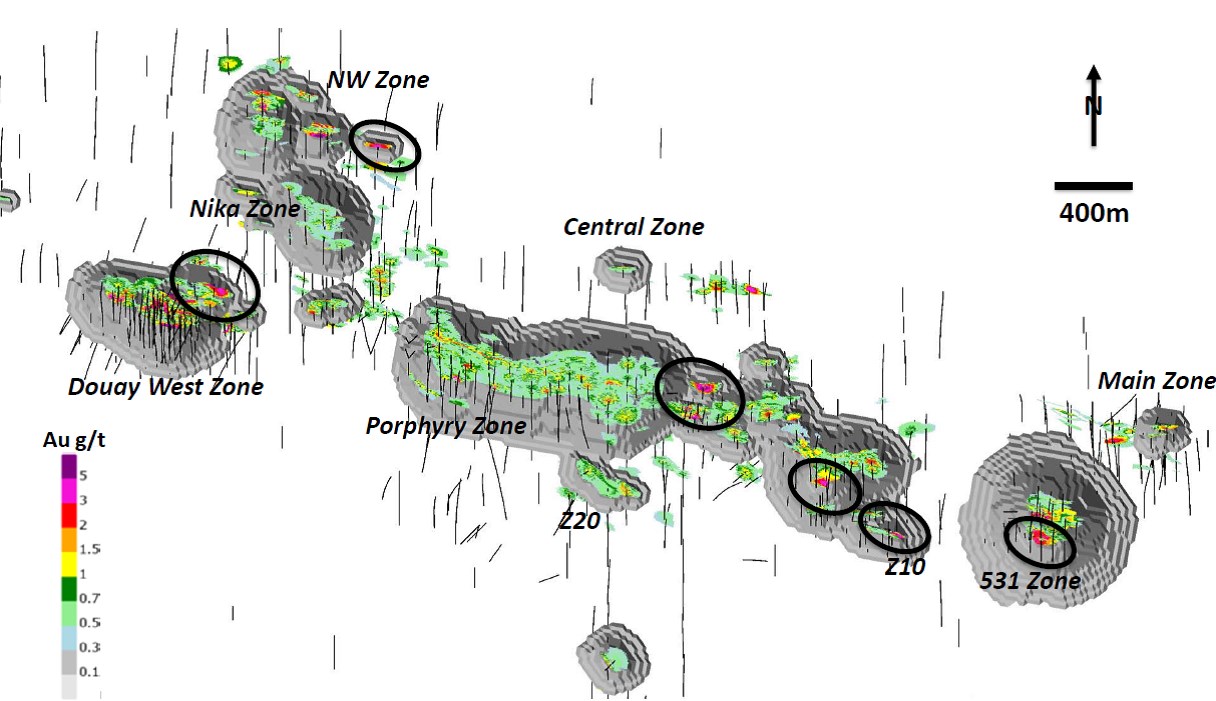

The deposit consists of nine mineralised zones; the Douay West and Porphyry zones account for the majority of the Mineral Resources. Significant exploration potential exists below and within the pit shells: from blocks situated between mineralised drill-holes too widely spaced to be included in the current estimate given the updated estimation parameters, and from undrilled gaps between the broader mineralised zones in part outside the new pit shells. Figure 1 below shows pit-constrained mineralised blocks at the 0.45 g/t Au cut-off grade, with black ellipses highlighting higher-grade (> 2 g/t Au blocks) on the edges of known zones, which remain open and represent priority drill target areas.

Douay remains a bulk-tonnage type deposit with significant exploration upside within the known resource area and district-scale greenfields exploration potential as well. The Project has excellent infrastructure and an almost entirely royalty-free gold endowment (only 1% NSR on small NW Zone).

Fig. 1: Plan view of RPA (2019) conceptual 3D pit shell with resource blocks at 0.45 g/t Au cutoff, and higher grade exploration areas shown (black ellipses). Note new Nika conceptual pit shell, merging with pre-existing NW Zone conceptual pit shell, but still detached from the Porphyry Zone. Note also new small conceptual pit shells in exploration areas to the NW of Douay West and south of Porphyry Zones

To view an enhanced version of Fig. 1, please visit:

https://orders.newsfilecorp.com/files/3077/49088_875edc45f4e44a99_001full.jpg

Underground Exploration Potential*

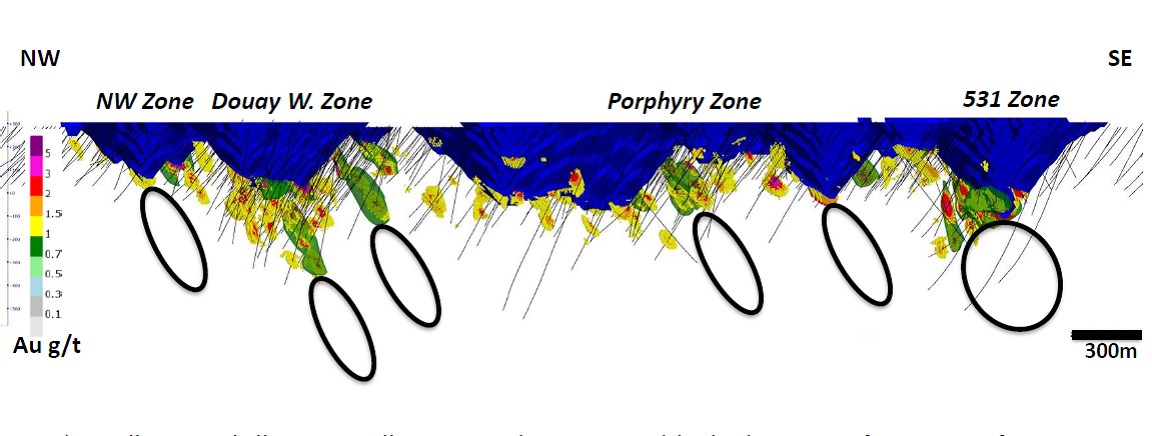

RPA has stated that the potential tonnage and grade of additional underground mineralisation below the new pit shells could be 10 to 30 million tonnes, grading between 1.5 g/t Au and 2.5 g/t Au for approximately 0.5 to 1.5 million ounces gold. Figure 2 shows the RPA reporting shapes in green (307,000 Inferred ounces averaging 1.75 g/t Au), as well as the mineralised blocks at various grades below the pit shells that were not included in the reporting shapes, and therefore not reported in the current Mineral Resource statement, due to insufficient drilling. The Company's recent results from the single 531 Zone drill-hole during 2019 (included intercepts of 16m @ 4.58 g/t Au, 9m @ 4.92 g/t Au and 9m @ 4.71 g/t Au - see press releases June 5, 2019) demonstrate the exploration potential for further higher-grade mineralisation. The black ellipses in Figure 2 below highlight further exploration potential at depth.

*The potential quantity and grade are conceptual in nature as there has been insufficient exploration to define a Mineral Resource along strike from the resource area, and it is uncertain if further exploration will result in the target being delineated as a Mineral Resource. The underground exploration potential estimated outside of the resource reporting pit shell is based on areas of mineralisation intersected by drilling, but not necessarily supported by two drill holes, which was required for Inferred Mineral Resources, plus the immediate down-plunge extension of known zones of mineralisation.

Fig. 2: NW-SE longitudinal vertical section view (all zones) showing distribution of below-pit shell underground blocks above 1 g/t Au cut-off. Only blocks within reporting shapes (green shaded area) form part of inferred underground Mineral Resource. Black ellipses point to undrilled exploration potential at depth, which is in addition to potential contributions from infill drilling in areas with current blocks.

To view an enhanced version of Fig. 2, please visit:

https://orders.newsfilecorp.com/files/3077/49088_875edc45f4e44a99_002full.jpg

Additional Mineral Resource Estimation Details

The Douay drill database includes 824 drill holes totaling 250,374 m, of which 674 and 220,347 m were drilled within the resource area. The resource wireframes are intersected by 539 holes for an accumulated interval length of 34,785 m. The three-dimensional wireframe models were generated using a nominal 0.1 g/t Au cut-off, taking into account not only assays but also geological and structural wireframes not available previously. Prior to compositing to three-metre lengths, high grade gold assays were cut to a level appropriate for each zone. Block model grades were interpolated using inverse distance cubed (ID3). Density values of 2.71 t/m3 or 2.82 t/m3 (depending on zone) were assigned to mineralised domains based on measurements from core samples. The Mineral Resources were assigned Indicated or Inferred category for Porphyry and Douay West zones, and Inferred only for other zones. The classification criteria used to define the Indicated Mineral Resources included spatial analysis, drill-hole spacing, and continuity of the mineralisation. RPA reported the Inferred Mineral Resources within 75 m from the drill intersection for most zones. The Porphyry Zone exhibits greater continuity and thicker intersections of mineralisation; hence the Inferred category was extended to 100 m up dip within only three domains within the Porphyry Zones.

Qualified Persons

The Mineral Resources disclosed in this press release have been estimated by Ms. Dorota El Rassi, P.Eng., an employee of RPA and independent of Maple Gold. By virtue of her education and relevant experience, Ms. El Rassi is a "Qualified Person" for the purpose of National Instrument 43-101. The Mineral Resources have been classified in accordance with CIM Definition Standards for Mineral Resources and Mineral Reserves (May, 2014). Ms. El Rassi, P.Eng. has read and approved the contents of this press release as it pertains to the disclosed Mineral Resource estimates. Further information about key assumptions, parameters, and methods used to estimate the Mineral Resources, as well as legal, political, environmental or other risks that may affect the Mineral Resource estimate will be included in a NI 43-101 Technical Report to be filed on SEDAR within 45 days following the date of this news release.

The scientific and technical data contained in this press release was reviewed and prepared under the supervision of Fred Speidel, M.Sc, P.Geo., Vice-President Exploration, of Maple Gold. Mr. Speidel is a Qualified Person under National Instrument 43-101 Standards of Disclosure for Mineral Projects. Mr. Speidel has verified the data related to the exploration information disclosed in this news release through his direct participation in the work.

Quality Assurance (QA) and Quality Control (QC)

Maple Gold implements strict Quality Assurance ("QA") and Quality Control ("QC") protocols at Douay covering the planning and placing of drill holes in the field; drilling and retrieving the NQ-sized drill core; drill-hole surveying; core transport to the Douay Camp; core logging by qualified personnel; sampling and bagging of core for analysis; transport of core from site to ALS laboratory; sample preparation for assaying; and analysis, recording and final statistical vetting of results. For a complete description of protocols, please visit the Company's QA/QC page on the website at:

http://maplegoldmines.com/index.php/en/projects/qa-qc-qp-statement

About Maple Gold

Maple Gold is an advanced gold exploration and development company focused on defining a district-scale gold project in one of the world's premier mining jurisdictions. The Company's ~355 km² Douay Gold Project is located along the Casa Berardi Deformation Zone (55 km of strike) within the prolific Abitibi Greenstone Belt in northern Quebec, Canada. The Project benefits from excellent infrastructure and has an established gold resource3 that remains open in multiple directions. For more information please visit www.maplegoldmines.com.

ON BEHALF OF MAPLE GOLD MINES LTD.

"Matthew Hornor"

B. Matthew Hornor, President & CEO

For Further Information Please Contact:

Mr. Joness Lang

VP, Corporate Development

Cell: 778.686.6836

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS PRESS RELEASE.

Forward Looking Statements:

This news release contains "forward-looking information" and "forward-looking statements" (collectively referred to as "forward-looking statements") within the meaning of applicable Canadian securities legislation in Canada, including statements about the prospective mineral potential of the Porphyry Zone, the potential for significant mineralisation from other drilling in the referenced drill program and the completion of the drill program. Forward-looking statements are based on assumptions, uncertainties and management's best estimate of future events. Actual events or results could differ materially from the Company's expectations and projections. Investors are cautioned that forward-looking statements involve risks and uncertainties. Accordingly, readers should not place undue reliance on forward-looking statements. For a more detailed discussion of such risks and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements, refer to Maple Gold Mines Ltd.'s filings with Canadian securities regulators available on www.sedar.com or the Company's website at www.maplegoldmines.com. The Company does not intend, and expressly disclaims any intention or obligation to, update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required by law.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/49088