Douay Gold Project

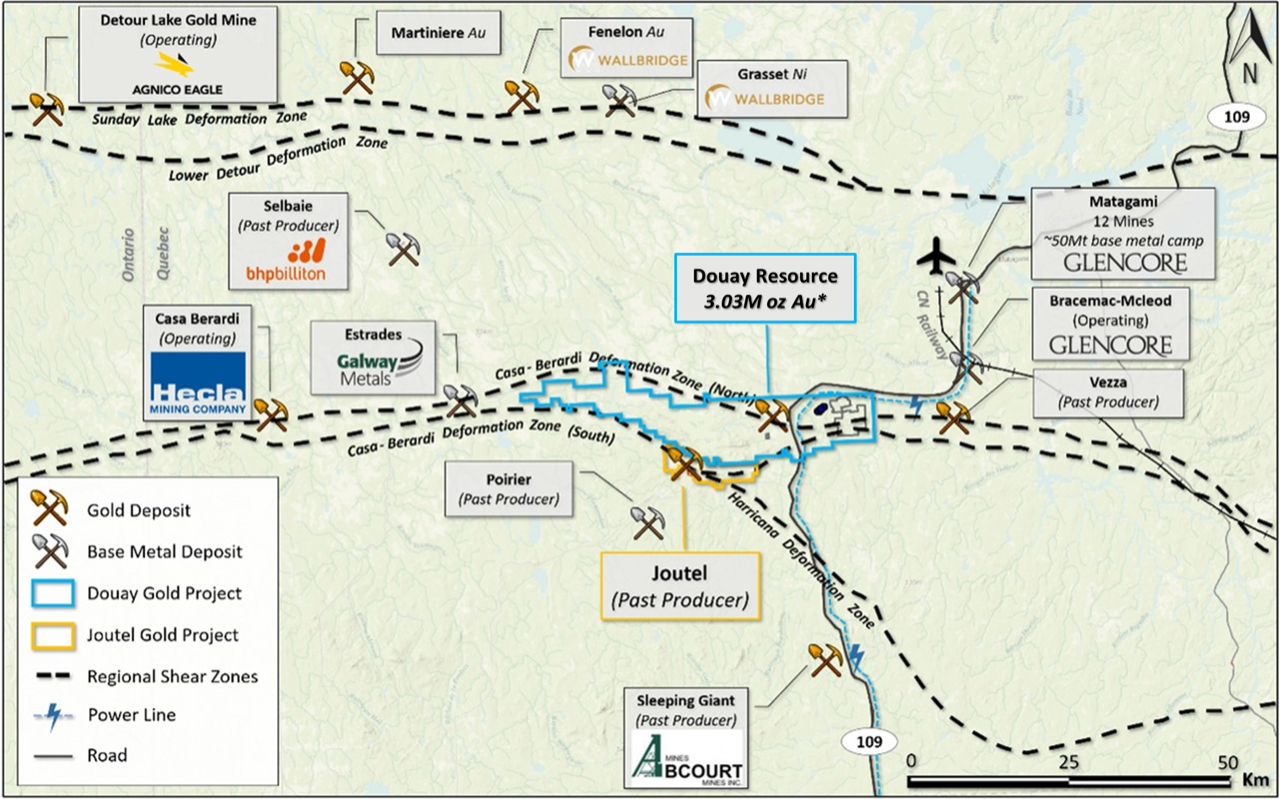

Douay is located ~55 km south of Matagami, Québec, with direct access via Highway 109. The project benefits from year-round road access, nearby power, and a skilled local workforce — ideal conditions for low-cost, efficient exploration and development.

Figure 1: Province of Québec with Location of Maple Gold’s Douay/Joutel Gold Project

Figure 2: Plan map showing location of Douay Gold Project

Québec’s Mining Advantages:

- Québec is one of the world's most attractive mining jurisdictions, consistently ranked in the Fraser Institute’s Annual Survey of Mining Companies.

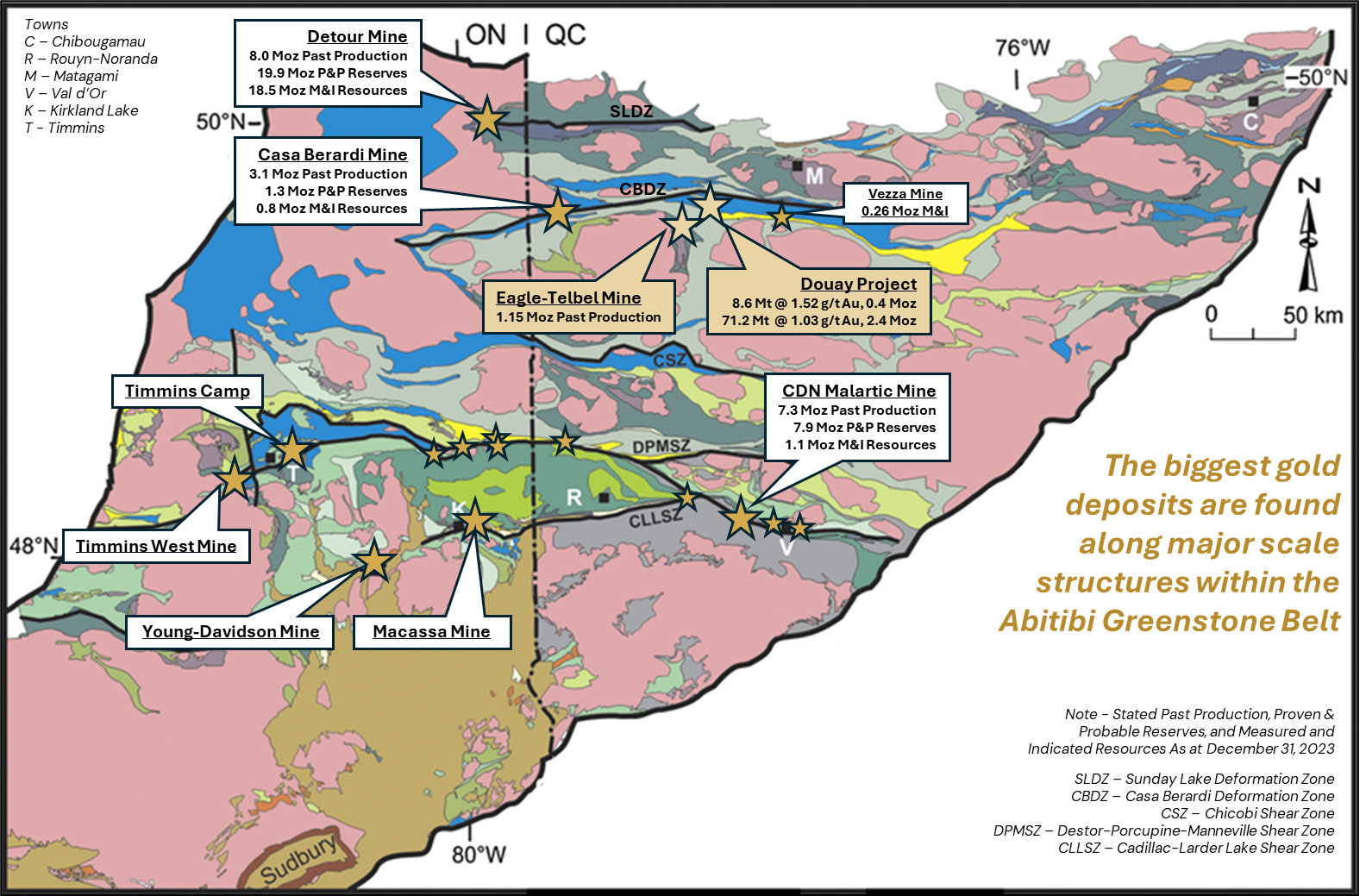

- The province hosts some of Canada's largest gold mining operations, including the Canadian Malartic mine (~150 km south), which shares geological similarities with Douay.

- Québec offers competitive tax incentives for exploration and development, with rebates of up to $0.37 per $1 spent on exploration.

The Douay deposit is situated within the northern Abitibi Greenstone Belt, a world-class Archean gold district. Gold mineralization at Douay is primarily hosted in a bimodal volcanic and intrusive sequence, dominated by syenitic intrusions and basaltic flows, crosscut by major deformation structures associated with the Casa Berardi Deformation Zone.

Figure 3: General Geology of the Abitibi Subprovince in Quebec with the location of Douay Gold Project, Casa Berardi Deformation Zone (CBDZ), and producing gold mines and camps.

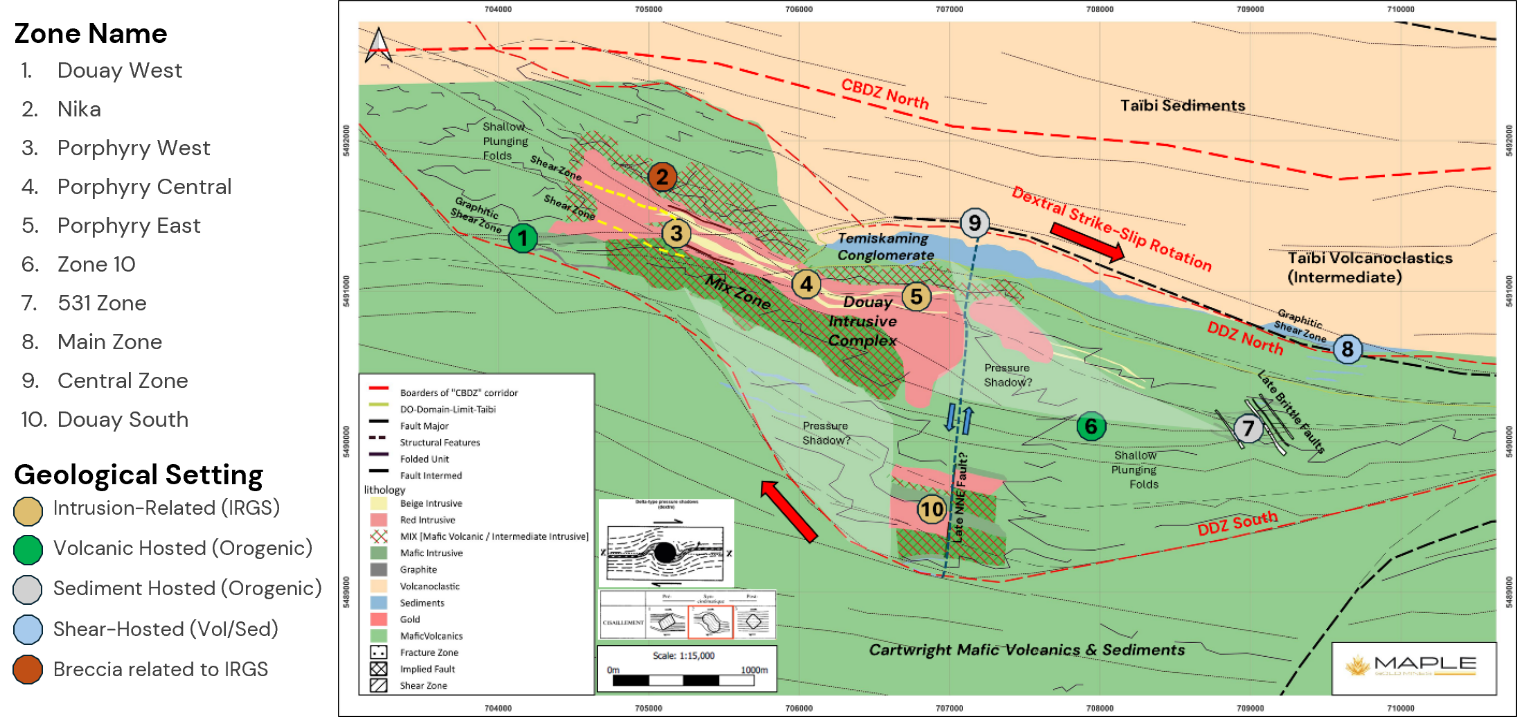

- Nika Zone: Syenite-hosted, broad, high-grade intercepts at depth; site of the 2025 step-out success (2.05 g/t Au over 108.6 m).

- Porphyry Zones (West, Central, East): Structurally-controlled, lower-grade, high-tonnage gold system comprising over 55% of current contained ounces.

- Central & NW Zones: Emerging areas of interest with higher-grade intersections and limited historical drilling.

- Taibi Target Area: Recently staked claims covering Taibi Group sedimentary rocks and banded iron formations north of the Douay resource area, representing a promising new exploration front along the projected northwest extension of the Douay Deformation Zone.

Figure 4: General Geology of Douay Gold Project showing outline of Douay Deformation Zone with potential strike-slip rotation generating pressure shadows around the Douay alkaline intrusive complex. Main mineralized zones are highlighted by geological setting.

Mineralization remains open laterally and at depth across all major zones, with particular emphasis now on bulk-tonnage underground targets beneath and beyond the current pit shells.Mineralization occurs as broad zones of disseminated and fracture-controlled gold within variably fenite-altered syenite, hydrothermal breccias, and intercalated volcanic rocks. Alteration assemblages include K-feldspar, amphibole, magnetite, quartz-carbonate, and chlorite, with 5–15% disseminated pyrite locally associated with elevated gold grades.

Nika Zone: Syenite-hosted, broad, high-grade intercepts at depth; site of the 2025 step-out success (2.05 g/t Au over 108.6 m).

Porphyry Zones (West, Central, East): Structurally-controlled, lower-grade, high-tonnage gold system comprising over 55% of current contained ounces.

Central & NW Zones: Emerging areas of interest with higher-grade intersections and limited historical drilling.

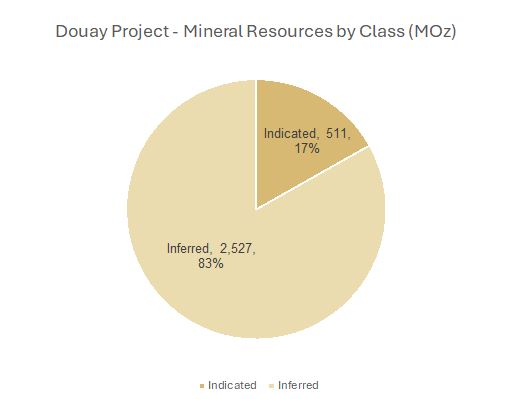

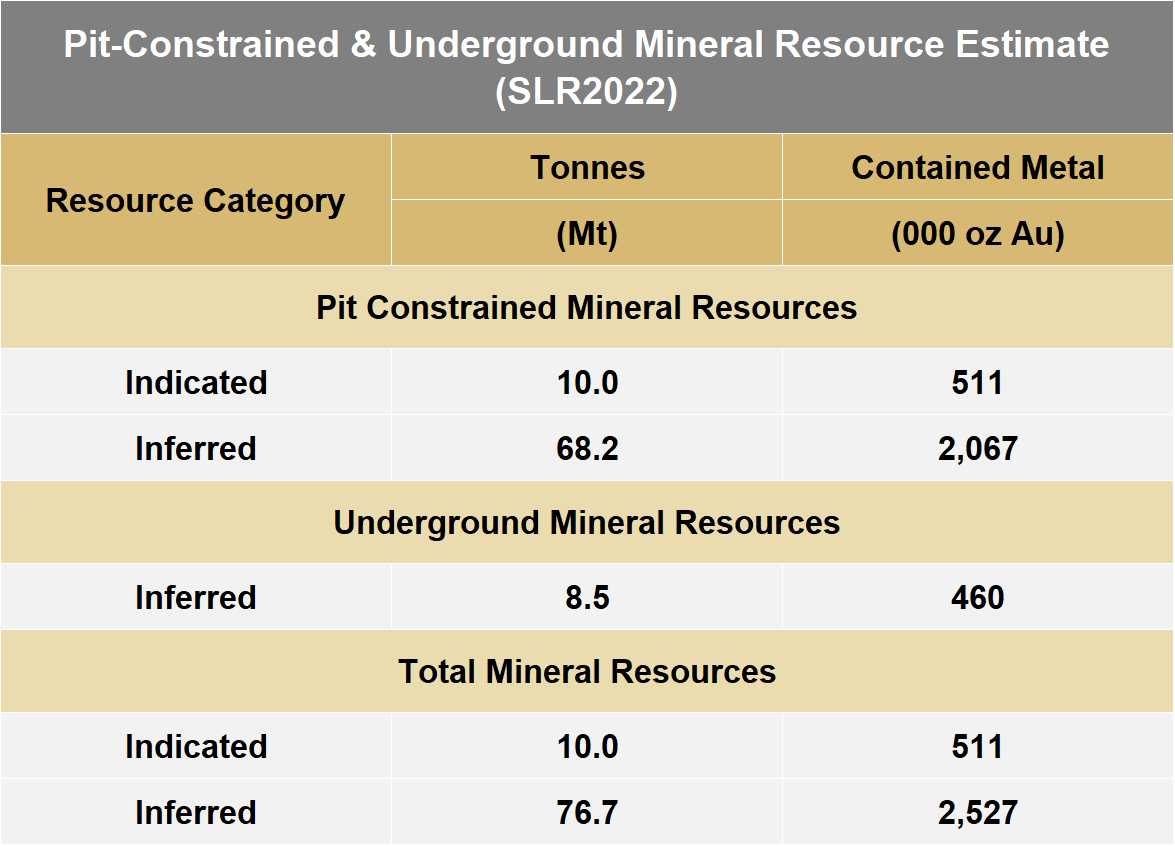

The Douay Gold Project hosts an established NI 43-101 mineral resource estimate, comprising:

- Indicated: 10.0 million tonnes grading 1.59 g/t Au for 511,000 contained ounces of gold

- Inferred: 76.7 million tonnes grading 1.02 g/t Au for 2.53 million contained ounces of gold

These estimates are based on a 0.45 g/t Au cut-off for open-pit resources and a 1.15 g/t Au cut-off for underground resources.

Further details on the key assumptions, parameters, and methodologies used in the resource estimate, along with potential legal, political, environmental, or other risks, can be found in the NI 43-101 Technical Report (SLR, 2022).

See Table 1and Chart 1for a detailed breakdown and Figure 6 and Figure 7 for MRE outlines.

Table 1: Douay Gold Project MRE

Chart 1: Douay Gold Project Mineral Resource Estimate (MRE); Mineral Resources by Class

Notes:

- The 2022 MRE is compliant with Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") Definition Standards (2014) incorporated by reference in National Instrument 43-101. The effective date for the Resource Estimate is March 17, 2022.

- Pit-constrained Mineral Resources are reported above a cut-off grade of 0.45 grams ("g") per tonne ("t") of gold ("Au") and underground Mineral Resources are reported with constraining shapes which were generated using a 1.15 g/t Au cut-off value and include low grade blocks falling within the mineable shapes.

- Pit-constrained Mineral Resources are reported within a preliminary pit shell using assumed mining costs of C$3.00/t mined (rock) and C$2.30/t mined (overburden), processing cost of C$9.10/t milled, G&A cost of C$2.70/t milled, and gold recovery of 90%.

- The Whittle pit shell used to estimate Mineral Resources used a long-term gold price of US$1,800 per ounce and a US$/C$ exchange rate of 0.80. However, the implied gold price for the Mineral Resources reported at the applied cut-off grade of 0.45 g/t would be significantly lower.

- Mineral Resources located outside the pit shell were reported on the basis of a potential underground mining operation at a gold cut-off grade of 1.15 g/t Au. This cut-off grade was based on mining costs of C$63/t and the same processing and G&A cost assumptions listed above.

- A minimum mining width of 3 metres ("m") was applied to the Mineral Resource wireframes.

Bulk density was interpolated for Nika, Porphyry, and 531 zones on a block per block basis using assayed values. For all other zones, bulk density ranging between 2.72 t/m3and 2.88 t/m3 was assigned to Mineral Resources based on the zone. - Numbers may not add due to rounding.

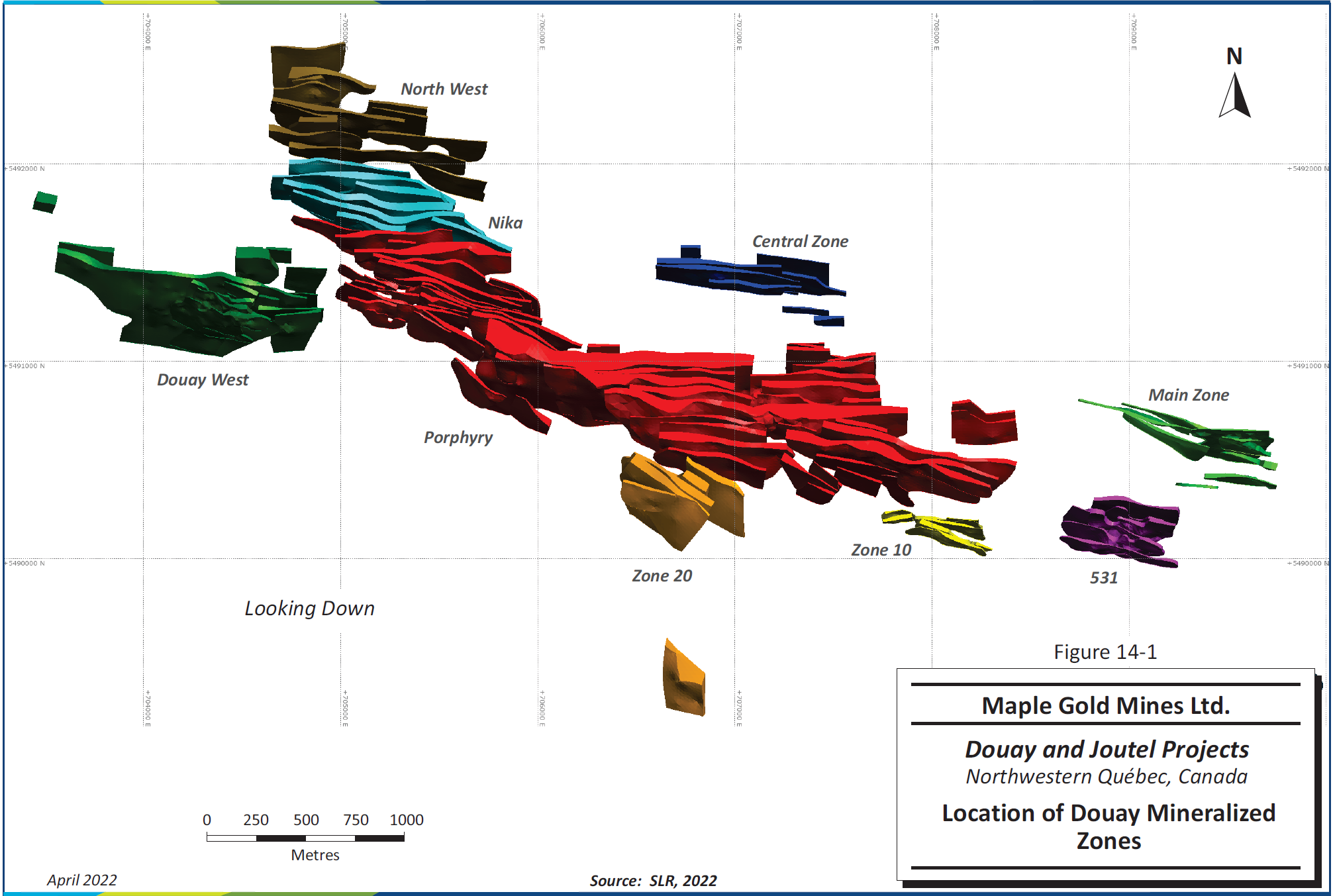

Figure 5: Douay and Joutel Gold Projects, Location of Douay Mineralized Zones (SLR, 2022)

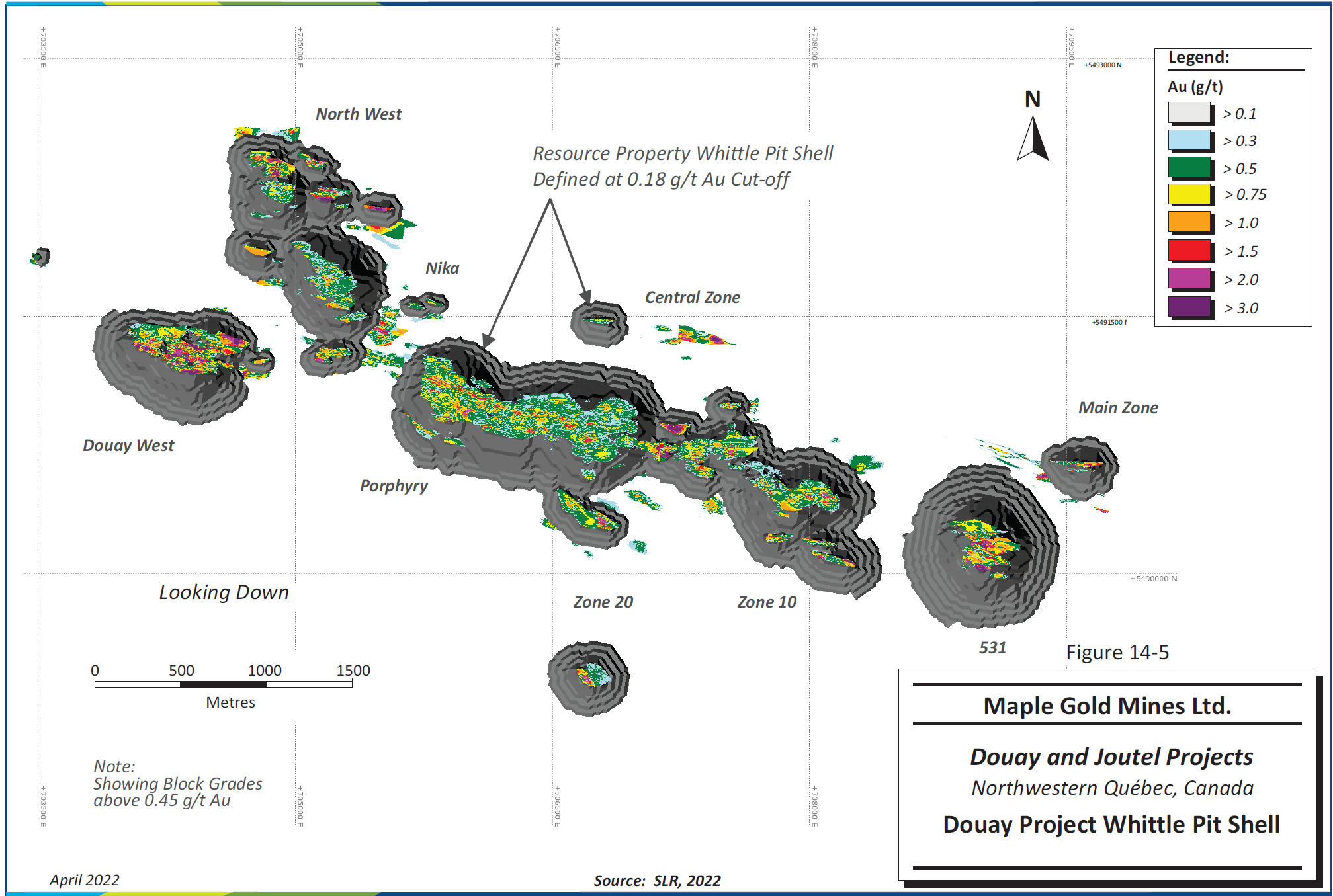

Figure 6: Douay and Joutel Gold Projects, Douay Project Whittle Pit Shell with Classified Blocks by g/t Au

• 3.05 g/t over 55.8 metres

• 4.93 g/t over 17.0 metres

• 15.31 g/t over 1.9 metres

- Expand: Step out from key zones at depth and along strike

- Upgrade: Target 100–200 m gaps to convert Inferred to Indicated ounces

- Explore: Test regional targets along underexplored lithologic breaks north of the MRE

- Refine: Validate new geological models to guide future phases of drilling