Eagle Mine Project

Overview & Highlights

- The Eagle Mine Property (“Eagle”) hosts the historical underground Eagle Mine, which formed part of Agnico's past-producing Eagle-Telbel mining complex. This operation produced approximately 1.1 million oz Au between 1974 and 1993 during a significantly lower gold price environment.

- In 2021, Maple Gold signed an option agreement with Globex Mining Enterprises Inc. (“Globex”) to acquire a 100% interest in the Eagle Mine Property, consolidating a strategic land position along the Harricana Deformation Zone, a dominant northwest-southeast gold trend that hosted the entire Eagle-Telbel mining complex.

- Maple Gold developed a 3D geological and structural model in Q4 2021, identifying high-grade gold targets beyond mined-out stopes. A year-long data review and compilation exercise in 2024, including historical drill core analysis and digitized data integration, revealed new geological and structural controls on gold mineralization and refined vectors for additional targeting.

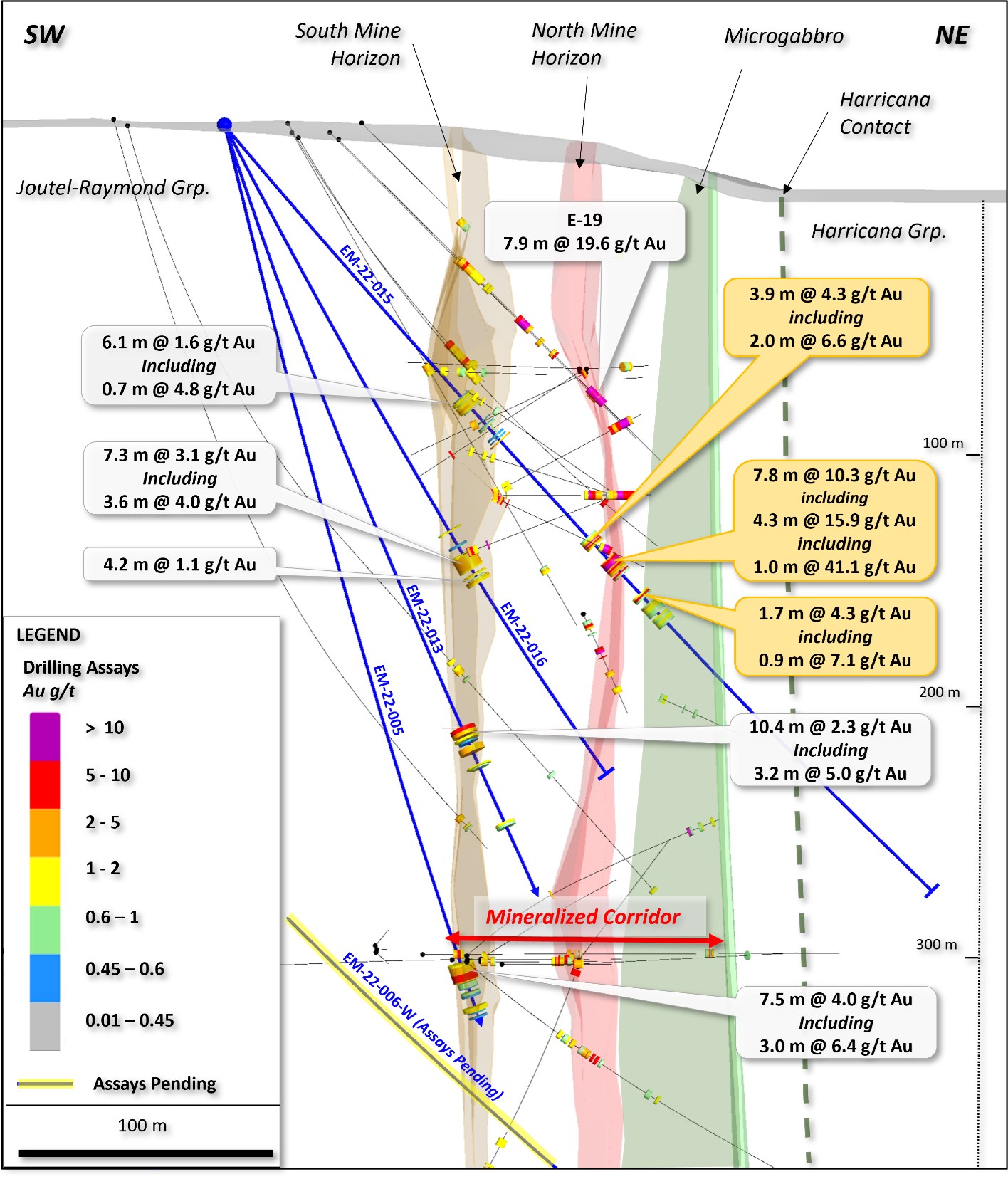

- Three drilling phases were completed in 2022, totaling 13,822 m across 28 drill holes. Highlighted results include: 4.0 g/t Au over 7.5 m, including 6.4 g/t Au over 3.0 m, in hole EM-22-005; 11.4 g/t Au over 3 m, including 24.4 g/t Au over 1.0 m, in hole EM-22-009; and 10.3 g/t Au over 7.8 m, including 41.1 g/t Au over 1.0 m, in hole EM-22-015.

- The 2022 drilling results confirm the presence of multiple sub-parallel gold horizons extending beyond the historically mined zones at Eagle. These results expand the broader mineralized corridor, which now demonstrates a stratigraphic thickness exceeding 100 metres in width.

• n 2021, Maple Gold signed an option agreement with Globex Mining Enterprises Inc. (“Globex”) to acquire a 100% interest in the Eagle Mine Property, consolidating a strategic land position along the Harricana Deformation Zone, a dominant northwest-southeast gold trend that hosted the entire Eagle-Telbel mining complex.

• Maple Gold developed a 3D geological and structural model in Q4 2021, identifying high-grade gold targets beyond mined-out stopes. A year-long data review and compilation exercise in 2024, including historical drill core analysis and digitized data integration, revealed new geological and structural controls on gold mineralization and refined vectors for additional targeting.

• Three drilling phases were completed in 2022, totaling 13,822 m across 28 drill holes. Highlighted results include: 4.0 g/t Au over 7.5 m, including 6.4 g/t Au over 3.0 m, in hole EM-22-005; 11.4 g/t Au over 3 m, including 24.4 g/t Au over 1.0 m, in hole EM-22-009; and 10.3 g/t Au over 7.8 m, including 41.1 g/t Au over 1.0 m, in hole EM-22-015.

• The 2022 drilling results confirm the presence of multiple sub-parallel gold horizons extending beyond the historically mined zones at Eagle. These results expand the broader mineralized corridor, which now demonstrates a stratigraphic thickness exceeding 100 metres in width.

Location & Jurisdiction

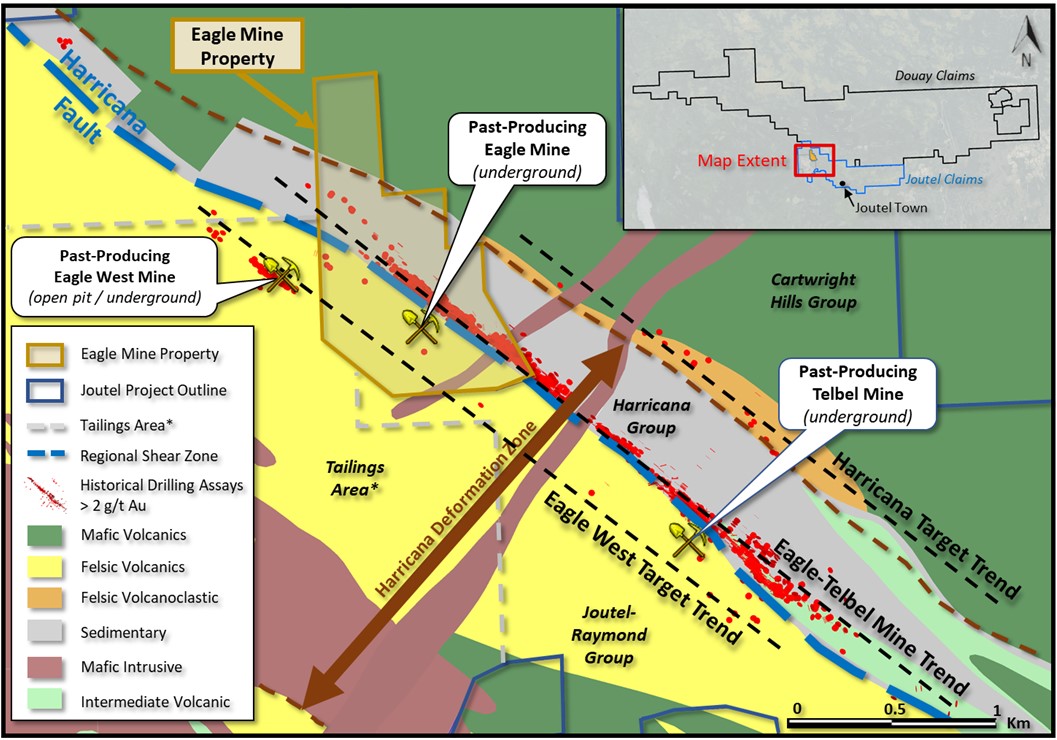

Eagle is a 77-hectare property located several kilometres west of the former mining town of Joutel in mining-friendly Québec, Canada. The property is readily accessible by the same Highway 109 that runs through the Douay Gold Project and connecting the towns of Amos and Matagami. The location and regional geological setting of Eagle are shown in Figure 1.

Figure 1: Plan view on regional geology base map showing location of the Eagle Mine claim along with additional target trends and >2 g/t Au results from drilling highlighted (red).

History

The former underground Eagle Mine was part of Agnico's first gold operation, the “Joutel Mining Complex,” which also included the Telbel mine and the Eagle West open pit/underground mines. The Eagle Mine had a production shaft that extended to approximately 950 metres, with historical production beginning in 1974 before operations shifted to Telbel. Together with Telbel, which had a production shaft reaching 1,200 metres, the Joutel Mining Complex produced approximately 1.1 million ounces of gold (from roughly 5 million tonnes of ore at an average grade of 6.5 g/t Au) between 1974 and 1993.

From 2008 to 2015, Globex completed six widely spaced infill and step-out drill holes, including hole EM-14-001, which returned 12.4 m of 2.9 g/t Au from 347 to 359 m downhole, with a high-grade interval of 4.8 m at 5.4 g/t Au.

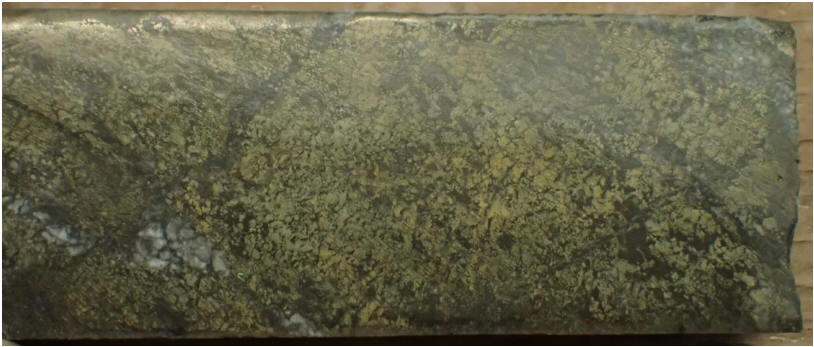

Globex’s drill core from this period, which was later repatriated by Maple Gold, revealed multiple sulfide horizons, with variable iron carbonate and quartz mineralization, primarily within a strongly deformed sedimentary and pyroclastic package. Similar alteration and mineralization were observed within weakly deformed subvolcanic mafic intrusives. This historical data laid the groundwork for Maple Gold’s ongoing exploration efforts.

Eagle Core: EM-14-001 intercept with semi-massive pyrite cut by iron carbonate veinlet (lower left) at 354.9 m, part of a 1 m sample interval that gave 13.7 g/t Au.

Recent Exploration Highlights

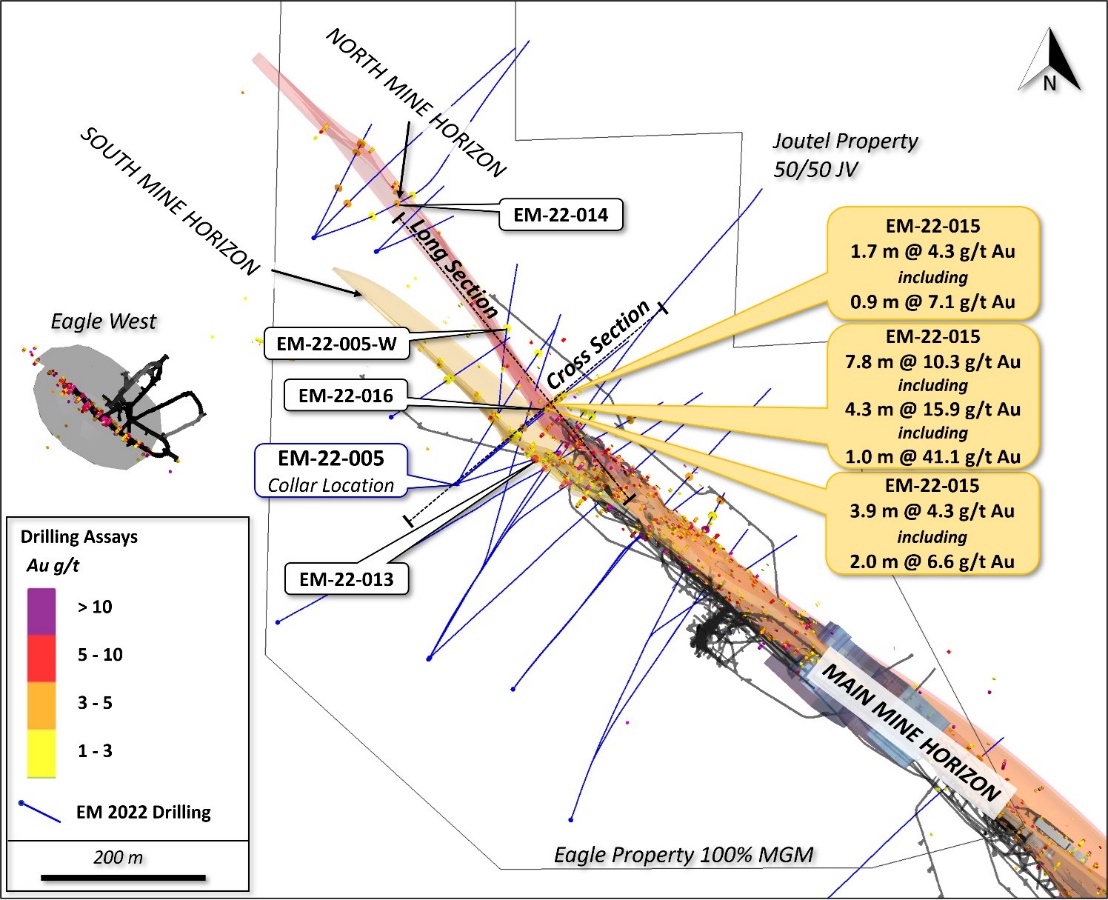

Three drilling phases were completed in 2022, totaling 13,822 m across 28 drill holes. Highlighted results include (see Figure 2 for hole locations).

- EM-22-005: 4.0 g/t Au over 7.5 m, including 6.4 g/t Au over 3.0 m

- EM-22-006W1: multiple intercepts including 6.5 g/t Au over 1.2 m, 2.0 g/t Au over 3.0 m and 2.3 g/t Au over 3.0 m.

- EM-22-006W4: 4.0 g/t Au over 0.7 m within a broader 1.1 g/t Au over 14.2 m.

- EM-22-008W: 6.2 g/t Au over 2.0 m and 4.2 g/t Au over 3.9 m.

- EM-22-009: 11.4 g/t Au over 3 m, including 24.4 g/t Au over 1 m

- EM-22-13: 2.3 g/t Au over 10.4 m, including 5.0 g/t Au over 3.2 m

- EM-22-015: 10.3 g/t Au over 7.8 m, including 41.1 g/t Au over 1.0 m

- EM-22-015: 4.3 g/t Au over 3.9 m, including 6.6 g/t Au over 2.0 m

- EM-22-016: 3.1 g/t Au over 7.3 m, including 4.0 g/t Au over 3.6 m

- EM-22-017A: 2.9 g/t Au over 2.0 m and additional lower grade over broader near-surface intervals (1.0 g/t Au over 15.5 m from 93 m downhole)

The results continue to confirm the continuity of mineralization and the potential significance of multiple horizons and splays northwest of the former Eagle Mine.

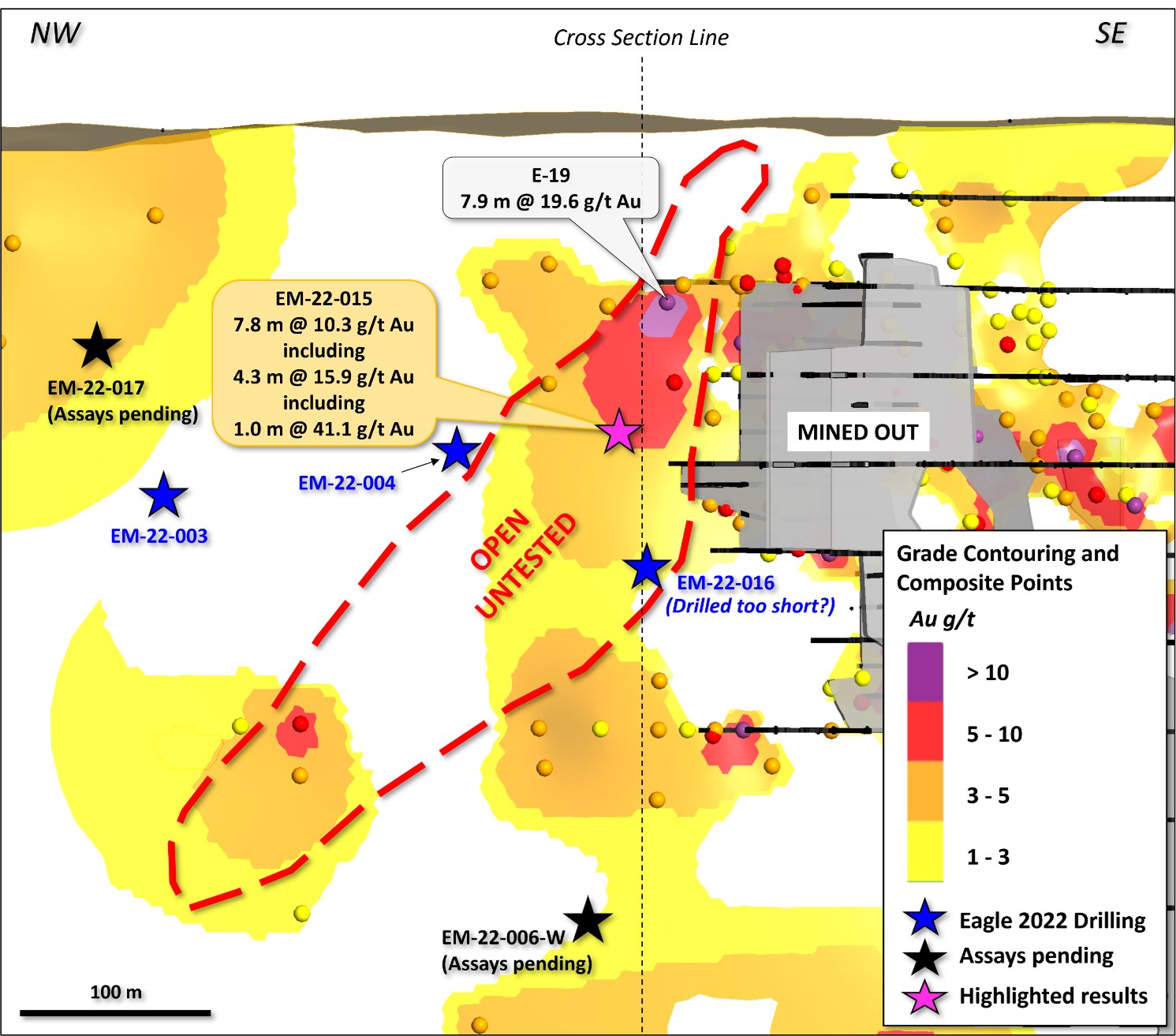

The continue to support the Company's view that multiple sub-parallel gold horizons exist beyond what was historically mined at Eagle and have expanded target areas along a broader mineralized corridor over a stratigraphic thickness that now exceeds 100 metres in width (see Figure 3). There is an apparent concentration of >10 g/t gold starting near surface and extending down-plunge to the EM-22-015 intercepts along the North Mine Horizon in an area with limited drilling that remains open further down-plunge (see Figure 4).

Figure 2: Highlighted results from EM 22-015

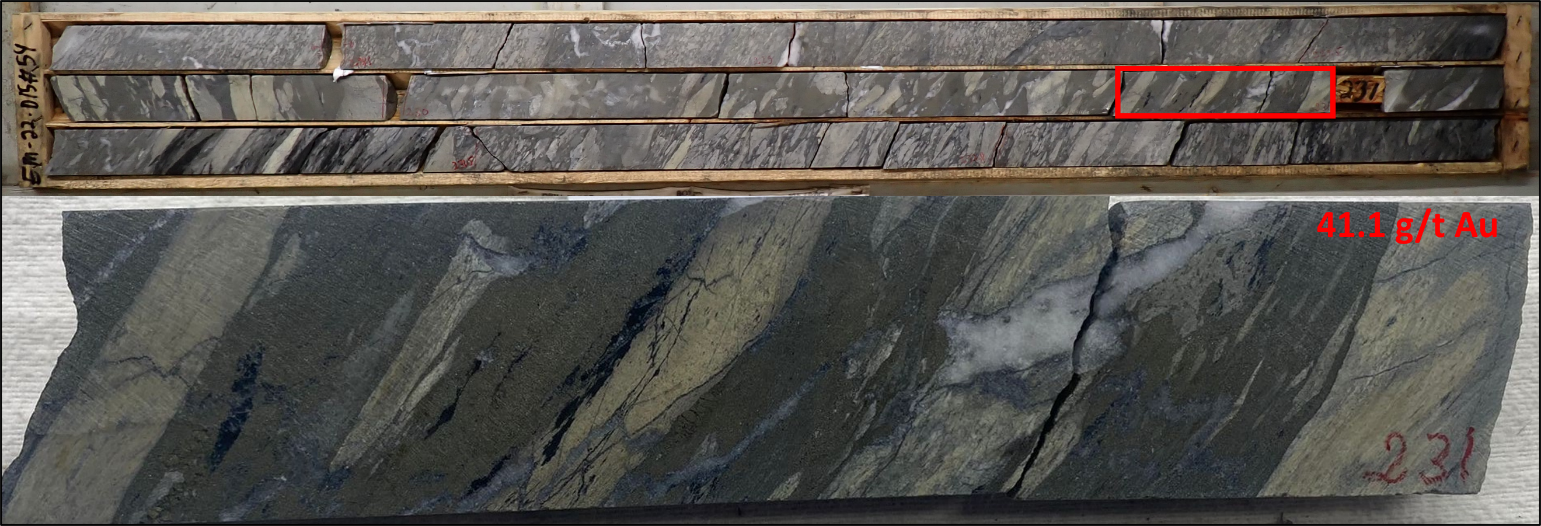

Eagle Drill Core: EM-22-015 intercept at 230.8 m downhole in lapilli-tuff host. Sulfide patches in between lapilli are semi-massive to massive. NQ core, 47.6mm diameter.

Figure 3: NW-looking cross section (85 m total width) highlighting new assay results (gold boxes) and previously reported/historical intercepts (white boxes) along well-defined sub-parallel horizons.

The EM-22-015 intercepts are located approximately 60 m down-plunge from historical hole E-19 (see Figure 4). Additional historical drill holes intersected >5g/t Au roughly 250 m further down-plunge, highlighting the grade and volume potential of this new zone that will be tested via follow-up drilling in 2023.

Figure 4: NE-looking long section (55 m total width) highlighting the location of the EM-22-015 intercept (10.3 g/t Au over 7.8 m) relative to pre-existing grade contouring in the North Mine Horizon. Note the open area extending down-plunge from hole E-19 (19.6 g/t Au over 7.9m).

Intercepts >2 g/t Au have now been obtained at Eagle at downhole depths ranging from 109 to 1,234 m, which is indicative of the significant depth continuity of the system.

Building on these findings, the Company has undertaken a comprehensive data review at Eagle, incorporating the 2022 drill results into its 3D geological model and refining priority targets for future drilling. By integrating its drilling results and observations with notable historical data and new geophysical insights, the Company has identified additional exploration opportunities that warrant further evaluation.

• EM-22-006W1: multiple intercepts including 6.5 g/t Au over 1.2 m, 2.0 g/t Au over 3.0 m and 2.3 g/t Au over 3.0 m.

• EM-22-006W4: 4.0 g/t Au over 0.7 m within a broader 1.1 g/t Au over 14.2 m.

• EM-22-008W: 6.2 g/t Au over 2.0 m and 4.2 g/t Au over 3.9 m.

• EM-22-009: 11.4 g/t Au over 3 m, including 24.4 g/t Au over 1 m

• EM-22-13: 2.3 g/t Au over 10.4 m, including 5.0 g/t Au over 3.2 m

• EM-22-015: 10.3 g/t Au over 7.8 m, including 41.1 g/t Au over 1.0 m

• EM-22-015: 4.3 g/t Au over 3.9 m, including 6.6 g/t Au over 2.0 m

• EM-22-016: 3.1 g/t Au over 7.3 m, including 4.0 g/t Au over 3.6 m\

• EM-22-017A: 2.9 g/t Au over 2.0 m and additional lower grade over broader near-surface intervals (1.0 g/t Au over 15.5 m from 93 m downhole)

Option Agreement Details

Maple Gold can acquire a 100% interest in Eagle by completing the following payments and exploration work over a five-year period (see Table 1 below):

Table 1: Earn-in Terms of Option to Acquire undivided 100% Interest

|

Time/Period |

Cash |

Shares |

Exploration |

|

On signing |

$50,000 (paid) |

$50,000 (paid) |

N/A |

|

6-month anniversary |

$50,000 (paid) |

$50,000 (paid) |

N/A |

|

12-month anniversary |

$50,000 (paid) |

$50,000 (paid) |

$200,000 |

|

18-month anniversary |

$62,500 (paid) |

$62,500 (paid) |

N/A |

|

2-year anniversary |

$62,500 (paid) |

$62,500 (paid) |

$300,000 |

|

3-year anniversary |

$75,000 (paid) |

$75,000 (paid) |

$300,000 |

|

4-year anniversary |

$100,000 |

$100,000 |

$400,000 |

|

5-year anniversary |

$150,000 |

$150,000 |

N/A |

|

Totals |

$600,000 |

$600,000 |

$1,200,000 |

Upon completion of the earn-in, Globex will transfer title and ownership in the Eagle Property to the direction of Maple Gold, free and clear of all encumbrances apart from a 2.5% GMR, which is subject to a Right of First Refusal and can be reduced to a 1.5% GMR in consideration of a onetime C$1.5 million cash payment.