Year-End Letter to Shareholders

December 31, 2025

Dear Fellow Shareholders:

As 2025 draws to a close, I want to reflect on what was an outstanding year for Maple Gold (“MGM”) and to look ahead to what promises to be a transformational 2026.

Two years ago, new leadership began implementing sound business strategies to address the underlying root causes of MGM’s historical underperformance. What started as a systematic evaluation of our people, projects, and partnerships evolved into a comprehensive company reset. A new team was assembled to drive exploration success at our flagship, 3-million-ounce Douay Gold Project. Our 50/50 joint venture partnership with Agnico Eagle Mines Limited (“AEM”) was creatively and accretively restructured. As a result, shareholders now benefit from 100% ownership of Douay, AEM’s past-producing, high-grade Joutel Gold Project, and a contiguous 481-square-kilometer land package in Quebec’s prolific Abitibi Greenstone Gold Belt, one of Canada’s most geologically prospective and infrastructure rich areas. In parallel, we raised C$9.6 million with strong support from AEM, institutional investors and insiders. Cost-saving initiatives were implemented, overhead was reduced by more than 50%, and capital was redirected toward advancing our assets. Together, these actions reflect the cultural shift toward accountability and ownership that is now firmly embedded at MGM.

Our unwavering commitment to long-term shareholder value creation did not go unnoticed by the market in 2025. The Company significantly outperformed all the main gold-related benchmarks: MGM is up 224% YTD compared to the GDXJ (up 154% YTD), the GDX (up 143% YTD), and gold itself (up 63% YTD). To put this performance in perspective, below are several of the major milestones we achieved during the year.

Between January and May, the Company completed a 12,241-meter Phase I drill program. This program successfully extended higher-grade gold mineralization well below the existing Douay Mineral Resource Estimate (“MRE”) conceptual pit shells and delivered several exploration breakthroughs, notably in the Nika Zone where step-out drilling delivered one of the best intercepts in the project’s history (2.05 g/t over 108.6 meters, including 3.05 g/t over 55.8 meters). This inaugural drill program under new leadership was completed on time, under budget and with no lost time incidents, reflecting improved project efficiencies and lower-than-expected drilling and camp costs.

In August, we announced an oversubscribed C$5 million private placement financing backed by new strategic investor Michael Gentile and our largest shareholder, AEM, alongside a concurrent 10 for 1 share consolidation, and a board refresh that added two highly respected mining industry veterans to our team. These actions broadened our shareholder base, improved our capital structure, strengthened our corporate governance, and created a clear pathway toward share price recovery.

Just weeks later, in September, we announced an upsized and oversubscribed C$13 million LIFE financing at a 100% premium to the August financing, anchored by a C$7 million lead order representing roughly 9.9% ownership of the Company from new institutional investor Franklin Templeton, one of the world’s largest precious metals funds.

The C$18 million we raised during the second half of 2025 fully funds all our key organic growth initiatives in 2026, including the largest expansionary drill campaign in MGM’s history, and two years of working capital. Importantly, more than half of the Company’s shares outstanding are now held by long-term investors. Our market capitalization and liquidity continue to grow at a sustainable pace, supported by consistent execution, increasing market awareness, and continued strength in the gold price.

We have built a strong foundation for future growth through focused exploration and disciplined development at Douay and Joutel, and we remain committed to maintaining our positive momentum. Looking ahead to 2026, key catalysts include results from our current 30,000-meter Phase II drill program, delivery of an updated MRE in the first half of 2026, and ongoing project de-risking initiatives. Over the next 12 months, our fully funded, multi-phase growth plan is designed to deliver meaningful resource expansion, discovery, and development milestones that drive long-term shareholder value.

This short video captures the spirit and excitement that is building as we head into 2026: https://youtu.be/kVdnLQZSZtQ?si=6NmGwSiPDVU1Swn0.

Thank you, as always, for your continued support. I wish you a happy and healthy holiday season and a successful and prosperous New Year ahead!

Best regards,

Kiran Patankar

President, CEO & Director

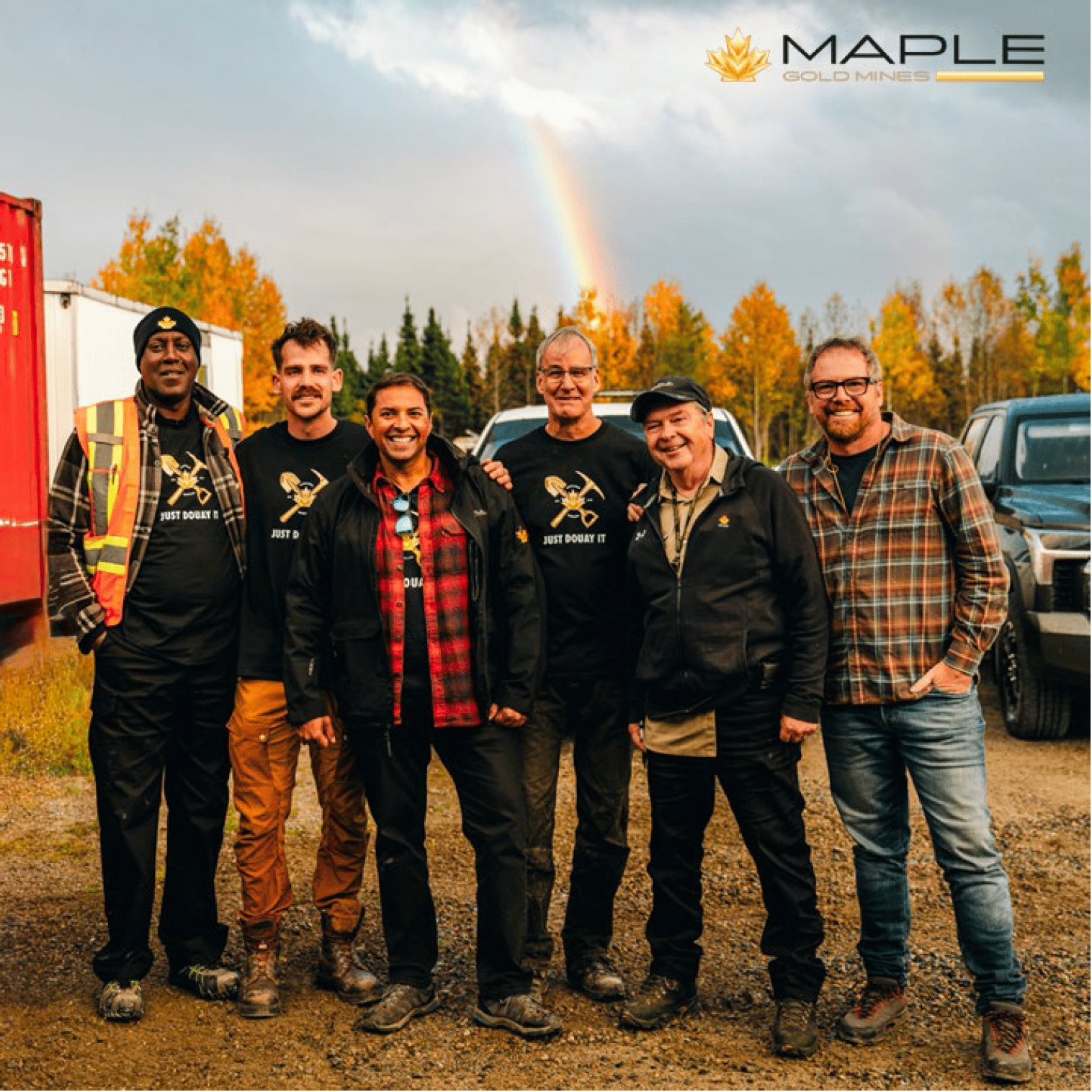

Here’s to finding the pot of gold at the end of this rainbow in 2026.